A grant is money set aside by both the state of Texas and the federal government for students who need it to pay for college. Grants are often called "gift aid" because they do not need to be repaid.

Lone Star College offers the following grant options:

Federal Grant Programs

Federal education grants are funds distributed by the United States government to students who need assistance paying for college. Federal grants do not need to be repaid.

If this is not your first enrollment period at Lone Star College and you received Title IV financial aid, your refunds for course withdrawals are calculated according to the Title IV refund guidelines. Title IV financial aid includes Federal Pell Grants, Federal Supplemental Educational Opportunity Grants.

- Federal Grant Eligibility

-

To be eligible for Federal Grants you must :

- Demonstrate financial need;

- Be a U.S. citizen or an eligible noncitizen;

- Be enrolled or accepted for enrollment as a regular student in an eligible degree or certificate program;

- Maintain satisfactory academic progress in college or career school;

- Sign statements on the Free Application for Federal Student Aid (FAFSA) stating that you are not in default on a federal student loan and do not owe money on a federal student grant and you will use federal student aid only for educational purposes; and show youíre qualified to obtain a college or career school education by having a high school diploma or a recognized equivalent such as a General Educational Development (GED) certificate or completing a high school education in a homeschool setting approved under state law.

- Federal Pell Grant

-

Federal Pell Grant award maximum is $7,395 for the 2024-2025 award year.

The amount you will receive will depend on:- Your financial need

- Your cost of attendance

- Your enrollment intensity

- Your plans to attend a full academic year or less

You may not receive Federal Pell grant funds from more than one school at a time.

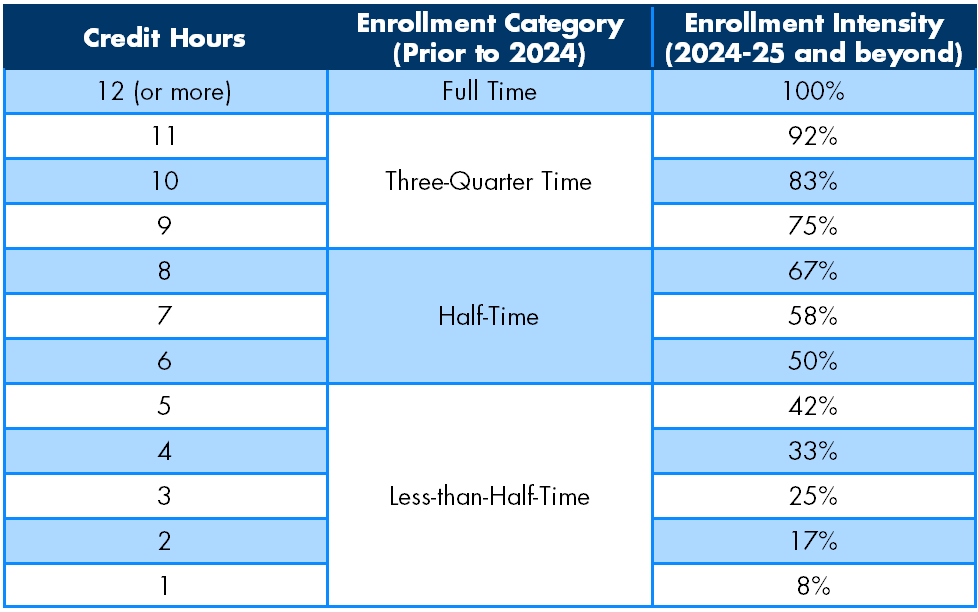

For the 2024-2025 school year, the way that Pell Grant eligibility is calculated has changed from previous years. The Department of Education now requires institutions to calculate award amounts based on a student's "enrollment intensity." Enrollment intensity is a percentage that represents how many credit hours a student is enrolled in compared to a full time course load. Pell Grant is generally initially offered based on 100% intensity, but changes in a student's enrollment intensity will result in adjustments to Pell Grant award amounts.

- Lifetime Pell Grant Eligibility

-

The amount of federal Pell Grant funds you may receive over your lifetime is limited by federal law to be equivalent of six years of Pell Grant funding. Since the maximum amount of Pell Grant funding you can receive each year is equal to 100%, the six-year equivalent is 600%.

The U.S. Department of Education uses a standard formula, established by Congress, to evaluate the information you report when you complete the Free Application for Federal Student Aid. How much you get will depend not only on your EFC but also on your cost of attendance, whether you attend full-time or part-time and whether you attend school for a full academic year or less. A student may only receive the Pell Grant from one school at a time.

- The U.S. Department of Education (ED) compares the actual amount you received for the award year with your scheduled award amount for that award year.

- If you receive the full amount of your scheduled award, you will have used 100%. Itís possible that you might not receive your entire scheduled award for an award year.

- If you did not receive the full amount of your scheduled award, (ED) calculates the percentage of the scheduled award that you did received.

- ED keep track of your LEU by adding together the percentage of your Pell Grant scheduled awards that you received for each award year.

For example, If you did not receive the full amount of your scheduled award, we calculate the percentage of the scheduled award that you did receive. For example, if your scheduled award for an award year is $5,000, but because you were enrolled for only one semester you received only $2,500, you would have received 50% of the scheduled award for that award year. Or if you received only $3,750 for the award year because you were enrolled three-quarter-time and not full-time, you would have received 75% for that year.

ED keeps track of your LEU by adding together the percentages of your Pell Grant scheduled awards that you received for each award year. The table below shows examples of the LEUs of three students who received differing amounts of their scheduled awards over a four-year period.

Note: From 2009 through 2012, it was possible for a student to receive up to two scheduled awards in a year. So some students will have a "percent used" of up to 200% for one or more of those years.

Of course, if a student's LEU equals or exceeds 600%, the student may no longer receive Pell Grant funding. Similarly, a student whose LEU is greater than 500% but less than 600%, while eligible for Pell Grant for the next year, will not be able to receive a full scheduled award.

- Federal SEOG Grant

-

The Federal Supplemental education Opportunity Grant (FSEOG) is for undergraduates with exceptional financial need who receive Federal Pell Grants. It does not have to be repaid. There is no guarantee that every eligible student will be able to receive an FSEOG. Students at each school may be awarded an FSEOG based on the availability of funds at that school.

Award amounts vary. Must be enrolled in 6 or more hours. Qualifications include, but not limited to:

- show exceptional financial need, with and Expected Family Contribution (EFC) lower than the federal cut-off rate, which is set each year;

- enroll at least half-time;

- have a high school diploma or a General Education Development (GED) Certificate, pass a test approved by the U.S. Department of Education, or meet other standards your state establishes that are approved by the U.S. Department of Education (See the financial aid administrator at the college or university for more information);

- be enrolled or a accepted for enrollment as a regular student working toward a degree or certificate in an eligible program (students may not receive aid for correspondence or telecommunications courses unless they are part of an associateís, bachelorís, or graduate degree program);

- be a U.S. citizen or eligible noncitizen;

- have a valid Social Security Number;

- make Satisfactory Academic Progress (SAP);

- sign a statement on the Free Application for Federal Student Aid (FAFSA) certifying that federal student aid will only be used for educational purposes;

- sign a statement on the FAFSA certifying that the student is not in default on a federal student loan and that the student does not owe money back on a federal student grant.

State Grant Programs

The following grants are state programs for credit courses.

- Texas Public Education Grant (TPEG)

-

Award Amounts vary. Must be enrolled in 6 hours. Qualifications include, but not limited to:

- Are Texas residents, non-residents or foreign students

- Show financial need

- Register for the Selective Service or are exempt from this requirement

- Texas Public Education Grant (TPEG) for Continuing Education

-

Some eligible programs may be partially funded based on need.

Qualifications include, but not limited to:

- All students must complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility/needed as outlined by the United States Department of Education. (This includes resolving all verification, C-code, and selective service flags to ensure eligibility)

- Undocumented students must complete the TASFA form as outlined by the THECB (Texas Higher Education Coordinating Board)

- All students must be accepted into the CE Department

- All students must complete the CE Financial Aid Form

- Texas Educational Opportunity Grant (TEOG)

-

2023-2024 Academic Year:

A full-time eligible student may receive up to $1,786 per semester. Qualifications include, but not limited to:

Initial year award, a student must:

- be classified by the institution as a Texas resident

- be registered with Selective Service, or be exempt

- have applied for any available financial aid

- have financial need

- be enrolled at least half-time as an undergraduate student in an associate degree or certificate program at a two-year institution

- not have attempted more than 30 semester credit hours (SCHs) (excluding credits for dual enrollment or by examination)

- not have earned an associate or baccalaureate degree

- not be concurrently receiving a TEXAS Grant

- not have been convicted of any felony; or any offense under the law of any jurisdiction involving a controlled substance as defined by Chapter 481, Health and Safety Code (Texas Controlled Substances Act)

Renewal year award, a student must:

- be classified by the institution as a Texas resident

- be registered with Selective Service or be exempt

- be a previous TEOG initial award recipient

- be enrolled at least half-time as an undergraduate student in an associate degree or certificate program at a two-year institution

- maintain satisfactory academic progress

- not have earned an associate or baccalaureate degree

- not be concurrently receiving a TEXAS Grant

- not have been convicted of any felony; or any offense under the law of any jurisdiction involving a controlled substance as defined by Chapter 481, Health and Safety Code (Texas Controlled Substances Act)

Students who continue in college and who meet program academic standards can receive awards for up to 75 semester credit hours, for four years, or until they receive an associate's degree, whichever comes first. The academic requirements for continuing in the program are: At the end of the first year, the student must meet the school's Satisfactory Academic Progress (SAP) requirements. At the end of the second year, the student must complete at least 75 percent of the hours attempted in the prior academic year and have an overall college grade point average (GPA) of at least 2.5 on a 4.0 scale.

Hardship Appeals

If a student does not meet the standards to continue receiving TEOG due to GPA or completion rate below SAP requirements, less than half time enrollment, more than 75 attempted credit hours, or enrollment past the 4-year limit, the institution may allow a student to continue to receive a TEOG award under hardship provision TAC, Title 19, Section 22.259.

Students who are ineligible due to a hardship condition, such as a severe illness/condition, an indication the student is responsible for the care of a sick, injured, or needy person that may affect their performance, or a requirement of fewer than six semester credit hours (or the equivalent) to complete their certificate or degree program can request a hardship provision. Students should contact any Lone Star College Financial Aid administrator on campus or by phone at (281)290-2700 to discuss requirements for hardship, request the appropriate forms, and discuss the required documentation to be submitted.

Lone Star College Financial Aid administrator will review the submitted form and documentation within 5-7 business days from the day all required documents have been received. Review may take up to 10 business days during peak enrollment periods. Students will be notified by email once a decision has been determined.

Please note that the following are not eligible for a TEOG Hardship Provision review:

- Students who have completed 75 hours while receiving the grant are not eligible for hardship.

- Students who have not received a TEOG award in previous terms.

Workforce Grants

The following grants are designated to provide funding for Associate of Applied Science (AAS) degrees, college credit level I and level II certificates and at times, non credit fast track certificate programs

- Skills for Small Business Program (TWC)

-

Description

Through the Texas Workforce Commission (TWC) Skills for Small Business program, up to $2 million from the Skills Development Fund is dedicated to the backbone of Texas' business communityóour small employers. Small businesses can apply to TWC for training offered by Lone Star College. TWC processes the applications and works with the college to fund the specific courses selected by businesses for their employees. This exceptional opportunity supports businesses with fewer than 100 employees, and emphasizes training for new workers though it also may help upgrade the skills of incumbent workers.

- The program offers free training to increase business competitiveness, upgrade the skills of current employees and prepare newly hired employees for job requirements.

- The program is in partnership with the Office of the Governor to further establish Texas as the premier place to support and expand the stateís small businesses.

Eligibility Requirements

Both student and employer must meet eligibility requirements per TWC.

Items Funded

Tuition and fees up to $1,800 per new employee or up to $900 per employee with the employer for one year or more

Class Details

Students can register for any class (credit or non-credit) that will increase their effectiveness at their jobs.

Contact Information

Name Phone Email Jason Curley

Director, Workforce Grants, Lone Star College281.290.5068 Request More Information

- WIOA (TWC H-GAC) Workforce Innovation and Opportunity Act (WIOA)

-

Description

Workforce Solutions scholarships support training for some of the region's high-skill, high-growth occupations. If you're interested in one of these careers, Workforce Solutions may be able to contribute to a financial aid package.

Eligibility Requirements

Eligibility is based on income level. Individuals who have been laid off, are receiving unemployment benefits, and are in need of training to enter the job market are also eligible. They must pursue one of the training programs listed on the Gulf Coast Workforce Boardís High-Skill, High-Growth Occupations list.

Find More Information about Workforce Scholarships

Workforce Programs

Programs approved on the Gulf Coast Workforce Boardís High-Skill, High-Growth Occupations list.

Items Funded

Tuition, fees, books and supplies

Class

Varies by program

Campus ContactsName Phone Email LSC-CyFair

Jaque Taylor281-290-5978 Jaque.d.taylor@lonestar.edu LSC-Kingwood

Lucy Solomon281-290-2826 Lucy.R.Solomon@LoneStar.edu LSC-Montgomery

Joyce Kitchen936-273-7027 Joyce.a.kitchen@lonestar.edu LSC- North Harris

Shonta Sumlin281-765-7972 Shonta.L.Sumlin@LoneStar.edu LSC-Tomball

Joyce Kitchen281-401-1863 Joyce.A.Kitchen@LoneStar.edu LSC-University Park

Lucy Solomon281-290-2826 Lucy.r.solomon@lonestar.edu Request More Information

- TPEG

-

Eligibility Requirements

Qualifications include, but not limited to:

- All students must complete the Free Application for Federal Student Aid (FAFSA) to determine eligibility/needed as outlined by the United States Department of Education. (This includes resolving all verification, C-code, and selective service flags to ensure eligibility)

- Undocumented students must complete the TASFA form as outlined by the THECB (Texas Higher Education Coordinating Board)

- All students must be accepted into the CE Department

- All students must complete the CE Financial Aid Form. This form may be obtained at the CE office.

Workforce Program

Some eligible programs may be partially funded based on need.

Contact: LSCCE@LoneStar.edu

Request More Information

- U.S. Department of Transportation Commercial Motor Vehicle Operator Safety Training Grant

-

Description

The U.S. Department of Transportationís Federal Motor Carrier Safety Administration has awarded Lone Star College a Commercial Motor Vehicle Operator Safety Training Grant. The money will be used to expand the number of Commercial Driverís License holders receiving operator safety training, to assist current or former members of the United States Armed Forces and their spouses with the opportunity to enter the trucking industry and extend grant opportunities to candidates from underserved communities as well as refugees.

This material is based upon work supported by the Federal Motor Carrier Safety Administration under a grant/cooperative agreement/subaward, dated September 29, 2023.

Any opinions, findings, and conclusions or recommendations expressed in this publication are those of the author(s) and do not necessarily reflect the view of the Federal Motor Carrier Safety Administration or the U.S. Department of Transportation.Funding:

VariesEligibility Requirements

Contact the Transportation and Logistics Technology Center at NH-TransportationLogistics@LoneStar.edu or call 346.380.6250.

Class Details:

Classes available within the following categories:

- CDL Truck Driver

Contact Information:

Please NH-TransportationLogistics@lonestar.edu to be contacted by an advisor

- Skills Development Fund

-

Description

Through the Texas Workforce Commission (TWC) Skills Development program, up to $500,000 is allocated to assist businesses in training new workers or enhancing the skills of existing employees. Businesses with 100 or more employees can enlist Lone Star College to apply for a TWC Skills Development Grant on their behalf. This grant facilitates the implementation of training provided by Lone Star College, encompassing both standard and tailored courses, as well as vendor training. The aim is to support businesses by financing the development and execution of customized job-training projects, ultimately raising the skill levels and wages of the Texas workforce. Lone Star College collaborates with TWC to manage grant applications and allocate funds to specific courses selected by participating businesses. This initiative primarily targets businesses with 100 or more employees, with a focus on training new hires while also accommodating skill enhancement for existing staff.

Key Features

- Free Training: The program offers complimentary training to enhance business competitiveness, upgrade the skills of current employees, and prepare newly hired staff for job requirements.

- Partnership: In partnership with the Office of the Governor, the program aims to bolster Texas' reputation as the premier destination for supporting and expanding small businesses across the state.

Eligibility Requirements

Both student and employer must meet eligibility requirements per TWC.

Items Funded

Tuition and fees, covering up to $2,000 per employee for 12 months of training.

Customized training tailored to meet the specific needs of the business.

Equipment costs necessary for training purposes.Contact Information

Jason Curley

Director, Workforce Grants, Lone Star College

281.290.5068

Jason.Curley@Lonestar.edu